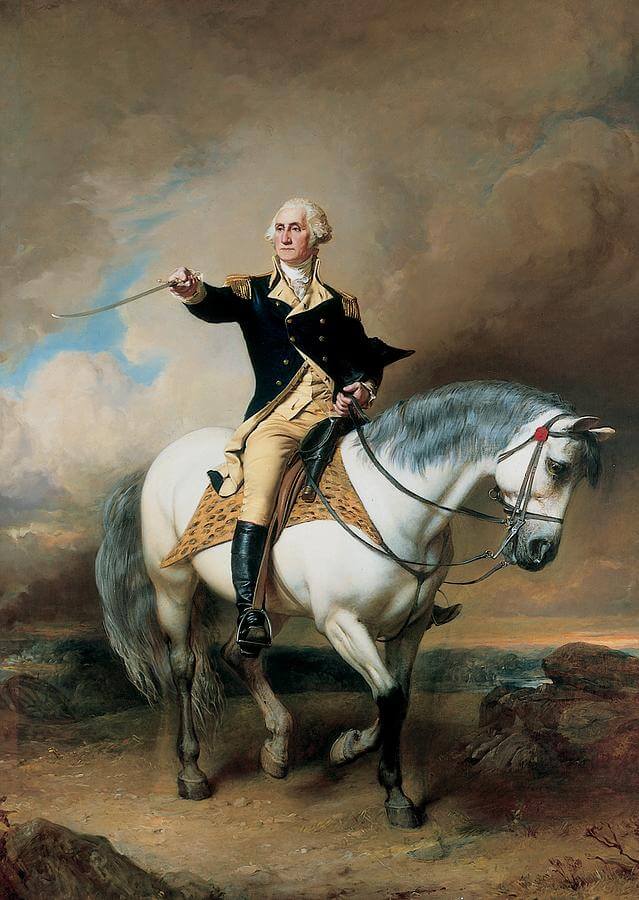

How Did Washington Impact The Financial Makeup Of The Us

It's Feb and time to celebrate George Washington's birthday, February 22, 1732. Washington, the 1st President of the United States, greatly contributed to foundation of the banking and finance manufacture. Washington said, "A people…who are possessed of the spirit of commerce, who see and who will pursue their advantages may achieve almost annihilation."

It's Feb and time to celebrate George Washington's birthday, February 22, 1732. Washington, the 1st President of the United States, greatly contributed to foundation of the banking and finance manufacture. Washington said, "A people…who are possessed of the spirit of commerce, who see and who will pursue their advantages may achieve almost annihilation."

Washington presided over the convention that resulted in the drafting of the United States Constitution which did not include a national bank. He also set precedents that are all the same in existence today including the chiffonier system and the inaugural address.

Cyberbanking in the U.s. is managed by the federal and state authorities. Nevertheless, Washington oversaw a financially stable national government and played a pivotal role in the development of national cyberbanking. He supported Alexander Hamilton'south programs to satisfy all federal and state debts that resulted in an efficient tax system and created a national depository financial institution.

The First National Banking concern

George Washington named Alexander Hamilton the first Secretarial assistant of the Treasury. He was the Father of the American National Banking Organisation because of his frustration regarding the receipt of funding from the states. Instead he was impressed with the British national banking system and thus created the Kickoff National Bank.

The purpose of a national bank was simple: To establish the United States as equal with the strange nations and to provide a standard bank note currency. The National Banking Acts of 1863 and 1864 established the regulation of national banks and created a national currency backed past the financial strength of the U.South. Treasury securities.

Redemption of the notes is reciprocal – every national bank must accept the bank notes of every other national bank. The Comptroller of the Currency is responsible for the printing, issuance and redemption of notes. Uniform style, outcome etc. is guaranteed and markedly decreases counterfeiting.

Advantages of National Banking concern

- Individual and Business concern Loans

According to the Federal Reserve Bank , "Banks are reporting…loan demand is picking up…loan growth has been stronger at regional and big banks." Loans facilitate entrepreneurialism and industry and merchandise increases. Additionally, business owners that are experiencing assisting ventures tend to make prompt payment of taxes.

- Lowest Interest Rates

While involvement rates are typically determined by a primal bank, a panel comprised of members of the Federal Reserve Lath and the Federal Reserve Bank assess the economical status of the country. Based on the needs of the nation, involvement rates are adjusted. The primary goal is to set a toll that volition support the stability of the economy. A robust economic system facilitates college prices, minimal circulation of money means price decreases.

- Subsidies for American Corporations

Experts estimate that during the last xv years, $68 billion in grants have been issued with near 66 percent allotted to big corporations. Funds provide tax relief, investments, new equipment, etc.

George Washington understood the power of fiscal dominance. The implementation of a global banking network demonstrated forward thinking and a dedication to democracy.

Source: https://www.careersingovernment.com/tools/gov-talk/about-gov/george-washingtons-vision-for-national-banking/

Posted by: tilleryafterand.blogspot.com

0 Response to "How Did Washington Impact The Financial Makeup Of The Us"

Post a Comment