How To Track A Money Order From Pls

Filling out a money order is a fairly straightforward process, but it's important to get it right. When filled out properly, these paper documents allow you to securely send or receive payments, providing an alternative to cash, checks or credit cards. Western Union says you should "think of a money order as a pre-paid check."

Here's what you need to know in order to purchase and fill out a money order correctly.

What you need to fill out a money order

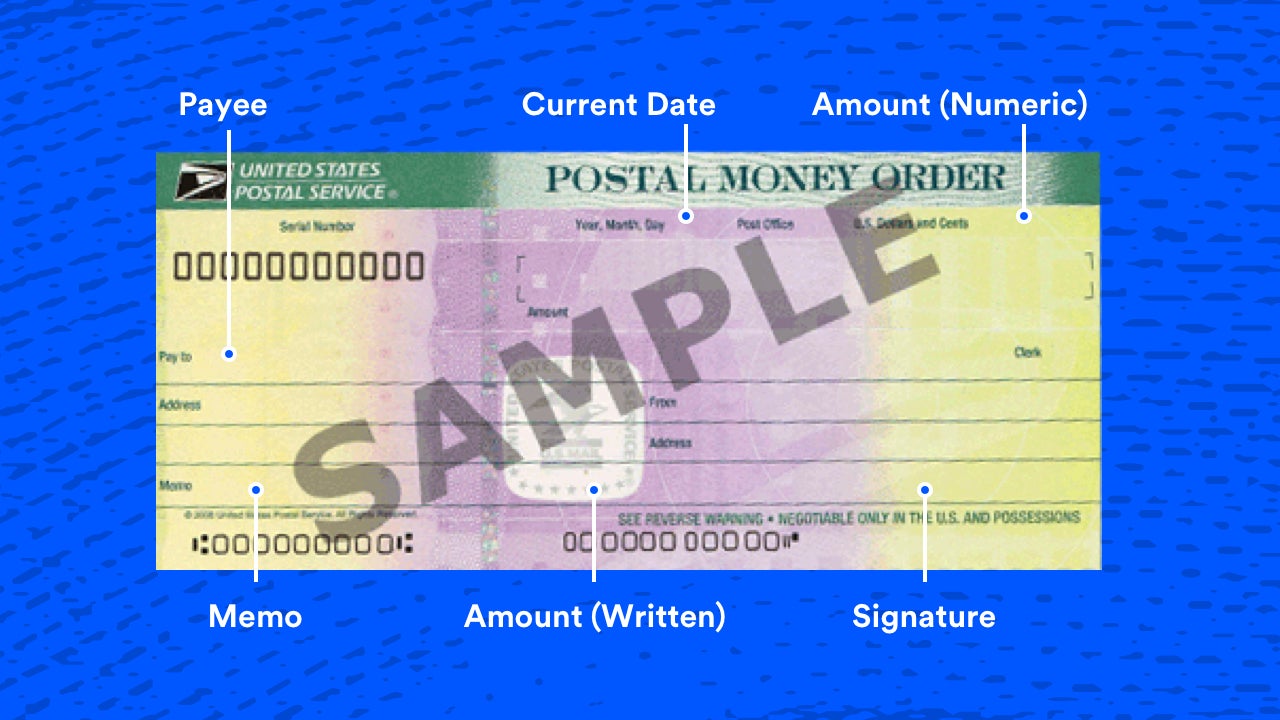

The requirements to fill out a money order vary by institution, whether its Western Union or the United States Postal Service. Each institution's money order may differ slightly in appearance as well. However, you'll generally need the following information:

- Name of payee (i.e. the person to whom the money will be paid)

- Payee's address

- Payment amount

- Your name and address

- What the payment is for and/or the billing account number

You'll also need a form of payment to purchase the money order (cash, check, debit card). Some issuers limit your payment options, too. For example, you likely won't be able to purchase a money order with a credit card.

Steps to fill out a money order

Once you've purchased your money order, fill it out carefully to make sure it will go to the right person and that he or she can cash it. Here are the steps to follow when you fill it out:

1. Fill in the name of the recipient

Write the name of the recipient of the money order in the "pay to" or "pay to the order of" field. This could be a person's name or the name of a business. Spell everything correctly, making sure your writing is legible and in ink.

It's important to fill out this section as soon as you purchase the money order, since this will be the only person authorized to cash or deposit. (If you lose or misplace a money order before you write in the payee's name, anybody can write in their name and cash the money order.)

If given the option, fill out your name in the field labeled "from," "purchaser" or "sender."

2. Include your address in the purchaser section

Fill in your address where the money order asks for the purchaser's address. There may be a second address field where you can fill in the address of the person or business you are paying or sending money to.

3. Write the account or order number in the memo field

A memo line allows you to note what the money order is designated for. For example, you can specify that it is to purchase a specific item or pay off a particular debt. If you have an account or order number from the payee, this is where to include it. This field might also be titled "payment for" or "account number."

4. Sign your name in the "purchaser's signature" section

Sign the front of the money order in the portion labeled for your signature. This section may be titled "Purchaser's signature," "Purchaser," "From," "Signer" or "Drawer." Do not sign the back of the money order. This is where the person or business that you are paying endorses the money order before they cash it.

Keep your receipt

Keep your receipt, which contains a tracking number. This number can tell you if the right person cashed your money order. And in case it is lost or stolen, you can use the tracking number to help you replace it. There may be a processing fee for replacing money orders. Your receipt can also help you cancel the money order should your plans change.

How to purchase a money order

You can buy a money order at banks and credit unions, check-cashing businesses, the U.S. Postal Service, many grocery stores and some big-box stores. You can use cash or a debit card to buy the money order.

However, you may want to avoid using your credit card to purchase a money order, as your credit card company may consider the purchase a cash advance. Cash advances may trigger steep fees, and you may be hit with a higher-than-normal interest rate until you pay off the balance. Some issuers won't accept credit cards as payment either.

There may be limits on the size of the money order you can purchase. The USPS, for example, allows you to buy money orders up to $1,000 if you're sending it within the U.S. On top of the price of the money order, you will typically have to pay a fee of between $1 and $10.

Bottom line

Money orders can be a useful way to send and receive money. They are a widely accepted way to make a payment, they never expire and if they are lost or stolen, they can often be replaced. And since money orders are prepaid, unlike checks, they won't bounce, which makes them a secure way to make purchases, pay debts or send money through the mail.

Knowing the ins and outs of how to acquire and use money orders allows you to add this dependable tool to your financial toolkit.

How To Track A Money Order From Pls

Source: https://www.bankrate.com/banking/how-to-fill-out-a-money-order/

Posted by: tilleryafterand.blogspot.com

0 Response to "How To Track A Money Order From Pls"

Post a Comment